Red Sea turmoil drives Chinese exporters to rail, other alternatives

A recent round of U.S. and British strikes on Houthi targets in Yemen raise fresh questions about the impact of container shipping in the Red Sea, as shippers continue to seek alternative means of navigating the crisis.

The strikes, which were conducted on Saturday, spurred threats from Houthi leaders and a warning from Jake Sullivan, national security advisor to President Joe Biden, that any direct response by Iran — rather than through the Houthi rebels it backs — “would be met with a swift and forceful response from us.”

China-Europe rates dip from January’s peak

Container shipping fundamentals have tightened as trade continues to be diverted from the Red Sea. Prior to the attacks, roughly 28% of container ship volumes passed through the Suez Canal, per analysis from Bank of America.

Now, those volumes are down 90%.

In the first quarter of 2024, LTL (parcel) trucking rates will be:

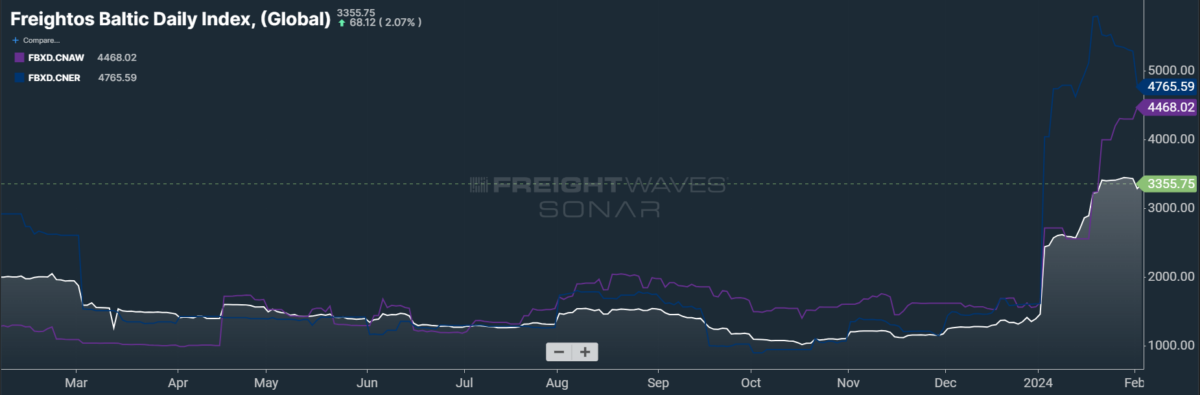

SONAR: FBXD.GLBL (white); FBXD.CNAW (purple); FBXD.CNER (blue)

In mid-January, the Freightos Baltic Daily Index (FBX) for China-Europe rates peaked at nearly $5,800 per forty-foot equivalent unit — a staggering gain of 260% since the start of 2024. Similarly, the Drewry World Container Index saw container rates from Shanghai to Rotterdam, Netherlands, spike nearly 200% over the last week of December.

Yet, despite the aforementioned rising tensions and increased military actions, these rates have already begun to dwindle.For one, some Chinese exporters have elected to avoid lengthy (and costly) reroutes around Africa’s Cape of Good Hope. Instead, these exporters are shifting to land transportation along the China-Europe Railway Express.

Dimerco, a Taiwanese logistics provider, reported a 30% increase in January for such rail volumes compared to the same period last year. With the costs of transporting goods along this rail network comparable to elevated ocean spot rates, the shift to intermodal has already proved significant enough to budge the needle.

China’s holiday marks a crossroads

Geopolitical strife aside, the recent growth in container rates out of China was largely caused by the cyclical rush to push exports ahead of the country’s celebration of Lunar New Year. This demand has already slowed ahead of this year’s holiday, which commences on Saturday and lasts for two weeks.

After the holiday, when manufacturing plants and port facilities come back online, some analysts argue that markets will have adjusted to the current state of affairs.

Lars Jensen, CEO of consultancy Vespucci Maritime, wrote in an online post that “we are getting past the peak of service disruptions” and that the Lunar New Year lull “will provide the necessary backdrop to fully normalize operations in the new round-Africa setup.”

Still, others argue that the Red Sea disruptions will have an enduring impact on the profitability of container shipping companies.

Jefferies analyst Omar Nokta estimates that capacity utilization among container ships has risen from 78% before the Red Sea crisis to 87%, which has “taken liners from a market with limited pricing power to one with meaningful pricing power.”

West Coast dominance continues

Ports along the US West Coast are seeing major growth relative to their East Coast counterparts. Over the past year, bookings at the Port of Los Angeles have risen 144% while bookings at the neighboring Port of Long Beach have risen 106%.

SONAR: IOTI.USLAX (white); IOTI.USNYC (purple); IOTI.USLGB (blue)

These ports suffered a long period of protracted congestion, labor insecurity and an increased focus on supply chain resilience that prompted shippers to become less reliant on a single gateway.

But with trade routes to the East Coast struggling against the turmoil in the Panama Canal — which has been plagued by ongoing droughts — and the Red Sea, the West Coast has regained its former appeal. The issue of labor was also resolved last year, when the International Longshore and Warehouse Union ratified a six-year contract with the Pacific Maritime Association.

Accordingly, bookings at the Port of New York and New Jersey are up only 40% over last year — dwarfed by the more-than-doubled growth at major West Coast ports.

This trend is expected to persist well into 2024 by many in the industry, including warehousing giant Prologis. Prologis previously predicted that the current freight recession would come to an end this year, spearheaded by growth in Southern California’s ports, warehouses and distribution centers.