Ocean Freight Carriers Are Ripe To Compete In The Air

Successfully managing assets and planning for the future are essential skills for ocean freight carriers. The high cost of new ships, which can take years to build and are expected to operate for decades, underscores the need for a long-term perspective in this industry.

This strategic mindset, combined with extensive experience in navigating challenging market conditions—something the maritime shipping sector has historically faced—positions A.P. Moller-Maersk A/S and CMA CGM SA well as they venture into the air freight market.

Both companies recently acquired new Boeing 777 freighters and have additional aircraft from Boeing and Airbus on order to enhance their capacity.

These new acquisitions reflect their commitment to diversifying their operations, a strategy they began to pursue during the pandemic when customers urgently needed both sea and air transportation.

In addition to expanding their air freight capabilities, Maersk and CMA CGM have also invested in the trucking sector of logistics.

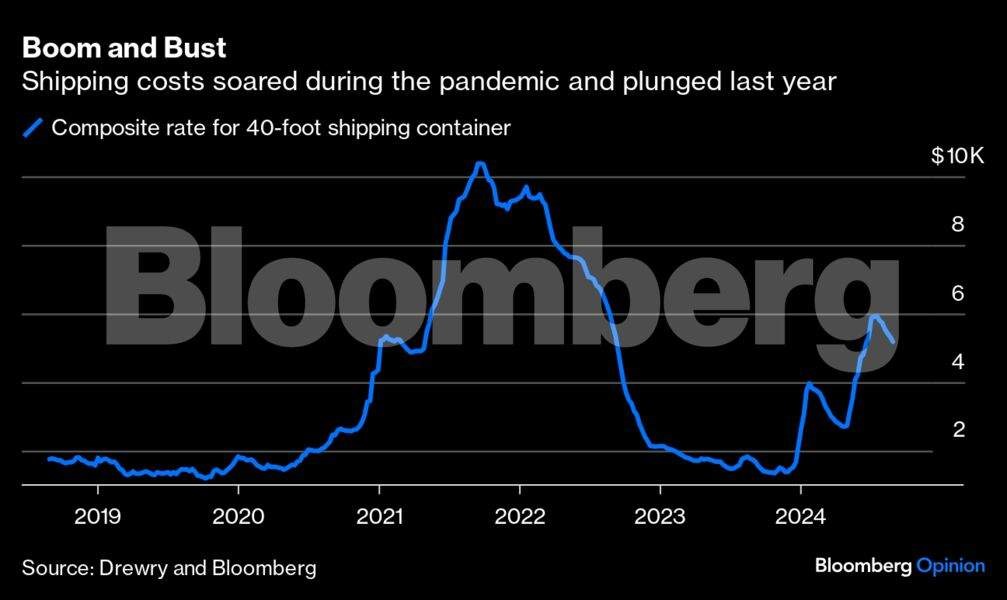

The surge in shipping rates during the Covid-19 lockdowns provided a significant financial boost, enabling marine operators to diversify. For instance, Maersk reported an operating profit of $31 billion in 2022 alone. However, the real challenge lies ahead. Maersk and CMA CGM must secure their positions in an intensely competitive market. The trucking industry is currently experiencing a downturn, with recovery still uncertain.

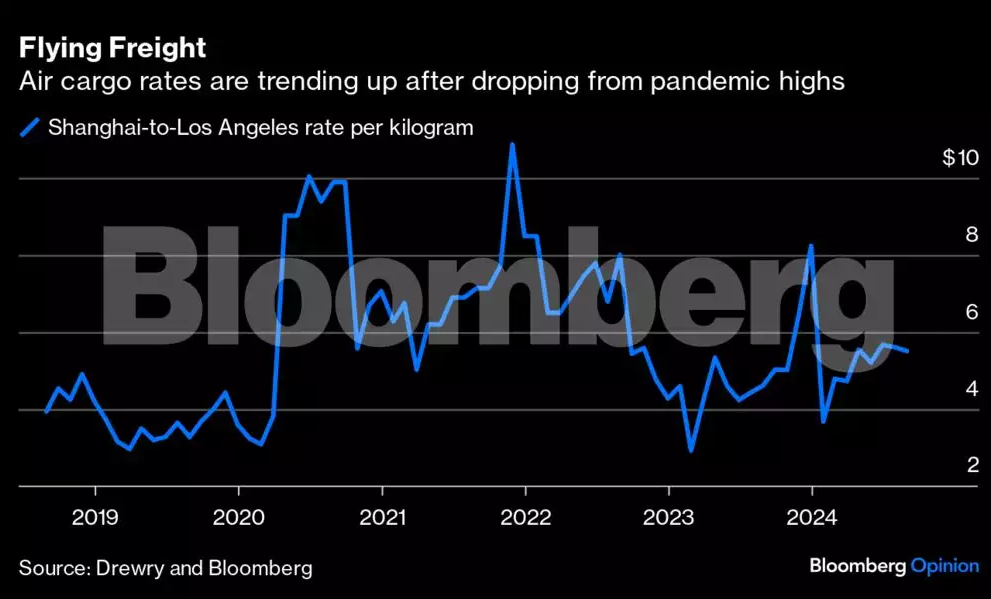

Conversely, air freight is showing signs of recovery, with a 14% increase in volume in July compared to the previous year—marking eight consecutive months of double-digit growth.

As the year-end peak season approaches, there is a strong possibility of further increases in demand, making this a pivotal time for these shipping giants.

Between 2015 and 2019, air cargo rates experienced an increase of 5% to 20% during the four weeks leading up to the end of the third quarter, as shown in detailed charts from Susquehanna Financial Group analyst Bascome Majors.

His data-rich visuals, reminiscent of Jackson Pollock’s abstract art, reveal significant trends. In a report dated September 3, Majors projected a moderate rise in air cargo rates as the industry approaches peak season.

While the timing appears opportune for shipping companies to enter the air freight sector, the market is highly competitive.

Major dedicated air freight players, such as FedEx Corp., Deutsche Post AG, United Parcel Service Inc., and Qatar Airways Cargo, dominate the landscape. Additionally, airlines are expanding belly capacity—the cargo space in the lower holds of passenger planes—as they resume normal operations, particularly on routes connecting to Asia.

Maersk and CMA CGM are adopting distinct strategies to establish their presence in this sector. Maersk, drawing on its historical experience in aviation, plans to manage operations internally.

The company previously operated a passenger airline from 1969 until its divestiture in 2005, and it has been flying cargo for UPS under the Star Air brand since 1987, which operated 15 aircraft in 2021. To strengthen its air cargo capabilities, Maersk acquired Senator International in 2022 and integrated it with Star Air to create Maersk Air Cargo.

In contrast, CMA CGM has opted for a partnership approach, collaborating with Atlas Air Worldwide Holdings—recently acquired by a private investor group led by Apollo Global Management.

The French shipping company aims to have 13 new Boeing 777 and Airbus A350 freighters by the end of 2027, according to Damien Mazaudier, head of the air cargo division. As CMA CGM looks to the future, questions remain about its long-term aircraft ownership ambitions.

“The sky’s the limit,” remarked Damien Mazaudier in a recent interview, emphasizing the gradual approach required for development in the air cargo sector.

The pandemic’s unprecedented influx of cash has enabled ocean carriers like Maersk and CMA CGM to begin establishing comprehensive asset-based logistics services. Although these companies will face stiff competition and fluctuating market demand, it’s crucial for them to adhere to their diversification strategies, even as the impacts of the pandemic recede.

The medium-term outlook for ocean carriers may be challenging, as global trade shifts away from the robust growth experienced since the 1990s. A notable trend is the relocation of manufacturing closer to consumer markets, driven by geopolitical tensions, particularly the deteriorating relationship between China and Western nations following Russia’s invasion of Ukraine. The pandemic highlighted the U.S. economy’s heavy reliance on Chinese goods, prompting a reevaluation of supply chains. Additionally, there are environmental benefits to producing goods nearer to their final destination, rather than transporting components worldwide. Advances in automation are also reducing labor costs, making it more feasible to manufacture in higher-wage regions.

The maritime shipping industry has long struggled with overcapacity. Companies often order new vessels during prosperous times, only for them to arrive when market demand has already cooled. Compounding this issue is China’s ambition to dominate maritime trade, backed by significant government investment in shipbuilding and port infrastructure. This strategic planning has enabled China to establish itself as a formidable player in both commercial and military maritime operations.

“It’s a boom-bust business, and the cycles never last long,” said Lee Klaskow, a senior analyst for logistics at Bloomberg Intelligence. He pointed out that when demand is high, companies order new ships, but once demand wanes, those vessels flood the market. Given the hefty price tags of $70 million to $100 million for these assets, utilization becomes critical. For context, Maersk reported combined operating earnings of $51 billion in 2021 and 2022, a stark contrast to $2.5 billion in 2018 and 2019.

As Maersk and CMA CGM work to diversify into new markets, they face a challenging road ahead. Ultimately, successful diversification could lead to more stable operations, reducing the cyclical nature of boom and bust in the maritime industry.